📈 When Debt Feels Like a Cage, Traceloans.com Hands You the Key

Debt isn’t always about poor decisions — sometimes it’s about survival.

A broken car, an unexpected hospital bill, a pandemic, a job lost in the wind.

And before you know it, your life is scattered across credit cards, overdue loans, and high interest rates.

But here’s the good news: You don’t have to stay stuck.

Traceloans.com offers a way out. A real one.

It’s not just about numbers. It’s about giving you back peace, clarity, and control.

What is Debt Consolidation? A Fresh Start in One Simple Step

Debt consolidation is the process of taking all your existing debts and rolling them into a single loan. Instead of juggling five credit cards, two personal loans, and a payday loan, you’ll have one loan with one monthly payment — often at a lower interest rate.

It simplifies your life and gives you a clear roadmap to become debt-free.

Think of it as pressing the “reset” button on your financial stress.

How Traceloans.com Makes It Easier

Traceloans.com is not a bank — it’s a debt relief platform designed to connect you with trusted lenders who specialize in debt consolidation.

✅ Here’s how it works:

- You fill out a simple online form — no stress, no jargon.

- You get matched with personalized loan offers from their network of vetted partners.

- You choose the best offer based on interest rate, monthly payment, and payoff time.

- Once approved, your loan pays off your existing debts.

- You make one simple payment every month — that’s it.

And the best part? It won’t hurt your credit to see your options.

⚖️ What Types of Debt Can You Consolidate?

Using Traceloans.com, you can consolidate:

- Credit card debt

- Medical bills

- Personal loans

- Payday loans

- Store credit lines

- Auto title loans

- Old utility or rent bills

If it’s weighing on your chest every month — chances are, you can roll it into one manageable payment.

Why People Trust Traceloans.com

Here’s what makes Traceloans.com stand out from the crowd:

⭐ No Hidden Fees

You pay nothing to check your options. No surprises, no fine print tricks.

⭐ Soft Credit Check

Curious if you qualify? They use a soft inquiry — it won’t lower your credit score.

⭐ Real, Personalized Offers

You’re not stuck with cookie-cutter loans. Traceloans.com matches you with tailored solutions based on your unique financial situation.

⭐ Fast and Online

The process is entirely digital and streamlined. You could have your consolidation loan funded in as little as 1–3 days.

A Real Story: Maria’s Debt Recovery

Maria was 29 and buried under $24,000 in credit card debt. The payments were endless, and the interest kept piling up. Despite working two jobs, she felt like she was running in place.

She found Traceloans.com late one night after searching for “how to get out of debt without filing bankruptcy.”

Within 24 hours, she had received multiple loan offers. She picked the one with a fixed APR and a 5-year payoff plan. Now, Maria makes one payment a month, and she’s on track to be debt-free by the time she turns 34.

She didn’t just find a loan — she found hope.

Who Is Debt Consolidation For?

It’s perfect for anyone who:

- Feels overwhelmed by multiple monthly payments

- Has high-interest credit cards

- Wants to reduce the total interest paid over time

- Is looking for a structured path to debt freedom

- Wants to avoid bankruptcy

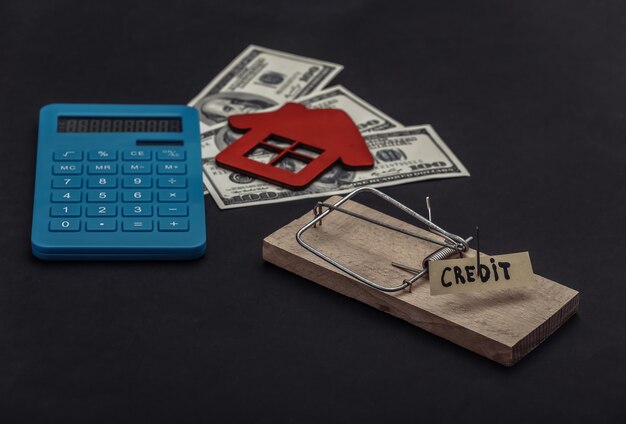

What to Watch Out For

Debt consolidation is a tool — not a magic wand. It’s only effective if you’re committed to:

- Not racking up new debt after consolidation

- Making consistent monthly payments

- Avoiding loans with super-long terms (they may cost more in the long run)

Traceloans.com is transparent, but it’s always wise to read every term and calculate the total cost of the loan over time.

Life After Consolidation: What Comes Next?

Once you consolidate, you’re not just paying debt — you’re building a future.

Here’s how to keep moving forward:

- ✍️ Create a budget and stick to it

- 💰 Start saving — even a little, each month

- 🔒 Limit credit card use until you’re financially stable

- 📈 Track your progress — seeing your balance shrink is motivating

- 🙌 Celebrate milestones — every payment is a victory

FAQs About Traceloans.com Debt Consolidation

Q: Do I need perfect credit to qualify?

A: No! Many lenders on Traceloans.com work with people with fair or even poor credit.

Q: Is Traceloans.com a lender?

A: No. It’s a loan matching platform — you get access to multiple offers in one place.

Q: Can I still use my credit cards after consolidating?

A: You can, but it’s best to avoid new debt while paying off your consolidation loan.

Q: What’s the interest rate range?

A: It varies based on credit and income, but consolidation loans typically offer better rates than credit cards.

Suggested Images for the Article

- 📷 A person tearing up credit card bills – “Freedom from financial chaos”

- 📷 A calendar with a single circled date – “One payment, once a month”

- 📷 A laptop showing the Traceloans.com dashboard – “Easy online application”

- 📷 A woman smiling at a coffee shop with a budget in front of her – “Peace of mind restored”

- 📷 A road opening through dark clouds – “A new financial beginning”

Final Thoughts: A Life Beyond the Bills

Your debt does not define you.

It is not your future.

It is simply a chapter — and you hold the pen now.

With tools like Traceloans.com, you don’t have to live in fear of the next bill.

You don’t have to feel buried.

You don’t have to stay stuck.

You can simplify your life. You can reclaim your income.

You can wake up and breathe easier.

Because one loan can change everything.